Inside the Dealerscope October 2021 DigiMag: From audio and wearables to retail and research, the full gamut of CE is represented among the nine honorees (and three up-and-comers) in the 2021 Powerful Women in Consumer Technology Awards. Read our interviews with each of these team leaders in tech. Plus, an overview of air purifiers, tips on improving your social media feeds, and a roundup that asks distributors how they’re handling inventory issues for the dealers they serve.

Congratulations to the Dealerscope 2021 Powerful Women in Tech

In August, I attended ProSource, Nationwide PrimeTime, BrandSource, and CEDIA. Some of you are thinking I was crazy; I know, but nothing is the same as seeing people face to face. That much was evident at Nationwide Primetime; I never before saw such a sea of smiles, so happy to be out and in person. Mind you, I did all the smart things, like limiting personal contact, having early dinners, avoiding socializing at bars open to the public, and staying in my room during the evening. Thankfully, my COVID tests are negative, and I was glad to be out and about. Make sure to check out our feature on live and hybrid events in this issue.

Our October issue is one of my favorites, because it’s where we honor the wonderful female energy in our industry. I personally congratulate all the women we’re featuring in this annual awards section. In August, at Nationwide PrimeTime, we launched a new program called “Dealerscope Insider Look,” where we attended events and moderated panels on video. One of the best was the “Women in Nationwide” panel. These women are intelligent, successful, fun, and great mentors to all genders in our industry. I invite you to look at this panel at https://dealerscope.com/insider-look/

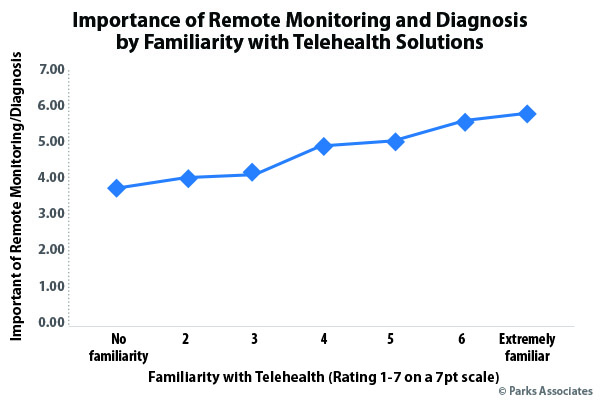

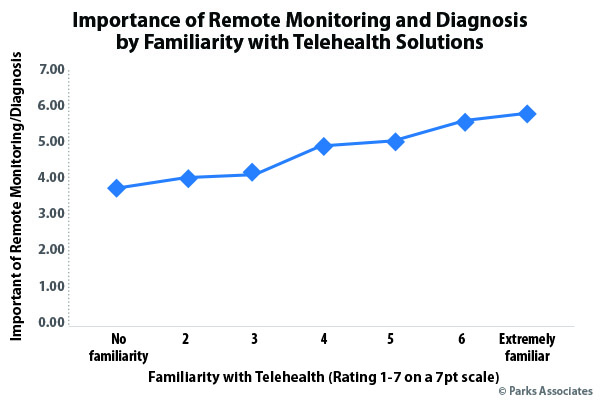

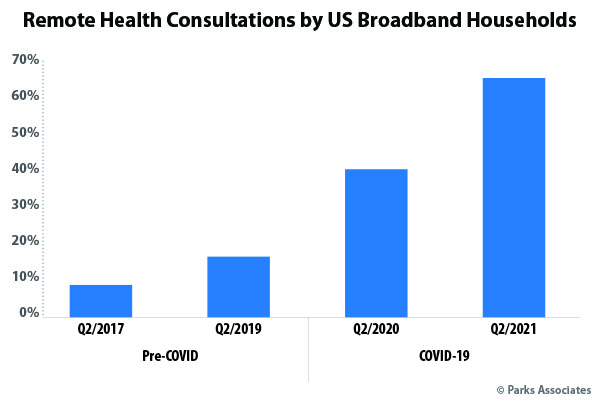

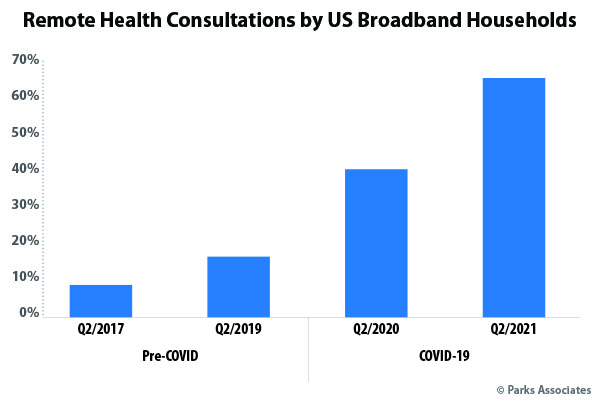

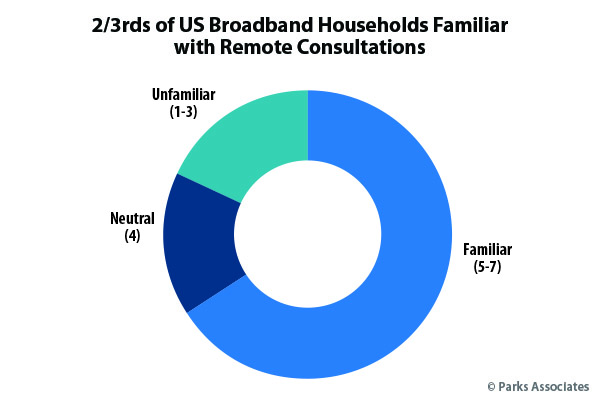

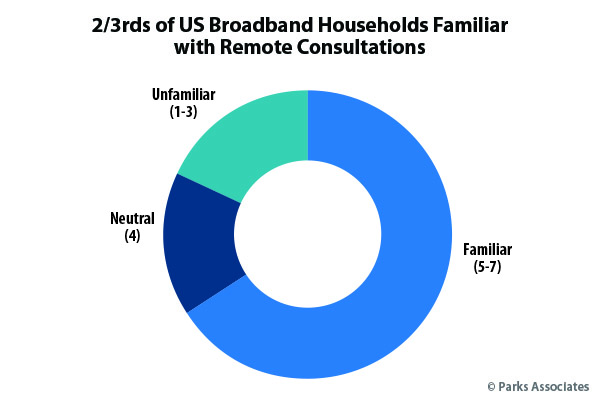

Dealerscope has lots more amazing content in October that I encourage you each to read. In Nancy Klosek’s Distributor Roundup, she polls distribution companies about how their businesses are doing and what initiatives are at the forefront of their strategies moving into 2022. Also, we welcome the editorial contribution from our monthly partnership with Parks Associates. Within this issue, Parks provide a great column on “Personalization in Connected Health: Impact of AI,” which touches on remote telehealth trends. Lloyd Wood, from GfK Etilize, offers tips on optimizing your e-commerce pages via better product content — very important, as we ride out this pandemic. In the Voices column, Tom Samiljan, our Editor in Chief, writes about the new focus on HR and workplace culture, which includes comments from John Riddle at Howard’s on its Wellness initiative. We also write about how to improve your social media with great quality images, examine several smart water devices, and cover the burgeoning air purifier market. You can see that the Wellness category is here to stay.

We hope that we are bringing you the information you need to improve your day-to-day business. If there are any topics that you feel need to be covered, feel free to contact me at tmonteleone@ctlab.media.

Tony Monteleone,

Group Publisher of CT Lab Global Media

A WORD FROM OUR EDITOR IN CHIEF

Treat Them Right

Hiring challenges force employers to finally focus on quality-of-workplace life and employee incentives.

If you’ve had trouble keeping employees or filling open positions lately, you’re not alone. Americans are quitting their jobs in droves — four million in April alone, according to the US. Department of Labor. Whether it’s because they found better positions or just burned out after more than 18 months of pandemic-era pressure, employees are on the move and the trend is real.

The result is, for the first time in what seems like decades, employers are starting to think about more than short-term profits and strategies to please shareholders. They’re no longer ignoring that other vital group of stakeholders, without which nothing would function: the employees.

At the recent 2021 BrandSource convention in Nashville, the buying group led with workforce analog and digital tools for independent retailers to help them recruit, hire, and retain employees. And in August, Southern California appliance retail chain Howard’s launched a health and wellness initiative that encompasses everything from a well-compensated intern program and flexible work schedule to easily available COVID testing and company-funded yoga and other wellness programs.

Howard’s CEO John Riddle credits this initiative to Johnny La Pasta, a Long Beach, Calif.-based corporate wellness consultant who not only trains the chief executive on yoga, meditation, and other fitness, but is also spearheading the initiative at Howard’s. In a recent interview with Dealerscope, Riddle said: “I saw the transformation in my own mind and body and thought, why can’t this be something we support on a broader basis?”

Riddle realized that mindful, slow, and long-term practices such as yoga and meditation might not be accessible to many Howard’s employees due to scheduling, location, or cost. And he wanted to make sure these programs were available to all employees, regardless of position. “What I see in our industry, in retail at least, is a lot of companies are doing things for the corporate or office level, but there aren’t as many offering such practices for individuals in the field at the in-store or location level,” said Riddle. “I want all the staff to feel like they’re valued and that they see these sessions as an added benefit of working at Howard’s. And I think the next level from a business standpoint is that it enables retention in an economy that’s making it tough to hire good staff.” While Riddle doesn’t have any specific figures around employee retention or productivity from the health and wellness initiative, he says Howard’s isn’t having any issues hiring or losing people. “We’re full up.”

Investing in a wellness program might not seem like a luxury for a growing company like Howard’s, but is such a holistic and initially unquantifiable approach within reach for smaller independent retailers? “Of course it’s easier for a company like ours that has a good size number of folks, since we can spread the cost better on a per-headcount basis,” said Riddle, “but I don’t see any reason why Nationwide, BrandSource, NATM, or other groups couldn’t organize something with this. Or independent retailers could just team up with other dealers for these sorts of things. Some insurance companies may even be willing to give a break on costs if it’s part of a company wellness program.”

With organizations such as Nationwide now offering insurance options via Lockton Health to its members, could expanded health and wellness initiatives be that far off?

Tom Samiljan

CE RETAIL TECHNOLOGY

October 2021 CE News

Companies Gear Up for Holiday Surge Amid Staffing Shortages | In-store shopping took a hit last holiday season as the coronavirus pandemic forced buyers to look online or pick up in-store, but this year, retailers are already planning for a renewed demand for in-store shopping. Walmart is looking to hire more than 20,000 part-time and full-time workers to staff up for the holiday. E-commerce giant Amazon wants to hire 55,000 new workers, with the majority based in the U.S. Drugstore chain Walgreens said it plans to raise its starting wage from $10 to $15 across the board by 2022.

Ebikes at Best Buy | Best Buy is getting in on the electric bike and scooter craze. The company will sell a variety of small electric vehicles from makers including Segway, Ninebot, Super73, Swift, and Bird. Right now, the products are only available online, but they’ll be in 10 Best Buy brick-and-mortar locations across the country beginning in October.

IKEA Bets on Delayed Payments | Swedish home goods tycoon IKEA is the latest in a slew of retailers to embrace buy now, pay later options for financing its products. IKEA invested about $20 million in an Ohio-based startup called Jifiti, which competes with other payment plan apps like Klarna, Affirm, or Sezzle to offer no-interest, short-term loans for buyers.

Apple CEO Considers Exit | Bloomberg reports that Apple CEO Tim Cook could depart the company within the next year. Company insiders tell the magazine that Cook wants to launch one more major product category before retiring early — he turns 61 this November. Apple plans to release a mixed-reality headset next year and it’s working on the Apple Watch 7, but facing delays because of manufacturing challenges.

Shopify Expands to TikTok | Social media network TikTok is adding Shopify selling features to its commerce offerings. TikTok’s new offering is called TikTok Shopping. Shopify merchants with TikTok for Business accounts can use the pilot program, which is now available, to create a digital storefront on the looping video platform. Similar shopping integrations are already available on competing social media sites such as Instagram and Facebook.

Image Makeover

5 tips for elevating your social media photography.

BY AMANDA NARCISI

Whether your business chooses to focus on Facebook, Twitter, or Instagram for its social media outreach, it’s more likely to make connections with photos rather than just texts or links. For many CE and appliance retailers, however, hiring a marketing team is not in the budget, so they are obligated to take matters into their own hands. Shooting photos and making the content copy is stressful and time-consuming enough without thinking about how to make the photos more clickable. With a few quick strategies, however, you can elevate your social media imagery — even pictures of everyday cables and other accessories — for more responses. Here are five top tips.

Change the perspective.

An exciting way to photograph technology accessories is to get close up, or shoot close to the object. For example, if you have a USB cord with braiding or exciting colors, you can lay them out and get close to the braiding to show the texture. Another option is to show the cords in use. For keyboards or mice, shoot the photograph close to the keys or along the curve of the mouse. Are you shooting with a phone camera? Turn the phone upside down to get the lens even closer to the accessory; you can even shoot facing upward to create a different perspective.

Add some color.

Consumer tech companies have broken away from the same-old, same-old eggshell or black colors for accessories, and the addition of new colors — brown, maroon, blue, pink, and so on — brings a lot to the table in terms of making seemingly mundane products stand out on social media.If you choose to show the hardware on its own in a still life, non-real-life scenario, choose a plain background to let the brilliant color stand out and highlight the piece’s aesthetic. Need a quick and inexpensive backdrop? Visit a local craft store for colored or textured paper. You can also buy surfaces; a foam core board with contact paper is also a great alternative.

Find inspiration in employees.

You may not have a marketing team, but you likely have creative employees with ideas on how to highlight a piece of hardware. Social media is also about adding a human factor to your business. What better way than having employees make a video or write the caption for their favorite sold hardware?

Broaden the scenarios.

Some of the most effective marketing photos in social media show a piece or multiple pieces of hardware arranged on a desk or a backdrop. You could highlight various hardware pieces and show off how the different hardware pieces — say, a mouse, a Bluetooth keyboard, and a gaming monitor — go well together, which is an excellent way to upsell. For real-life scenarios, don’t just think of at-home-office or office cubicle settings, but also consider travel scenarios in, say, coffee shops or poolside Airbnb rentals. So many startups and self-employed entrepreneurs are using coffee shops and co-working spaces to run their new ventures, and this is a relatable way to appeal to those customers.

Remember the details.

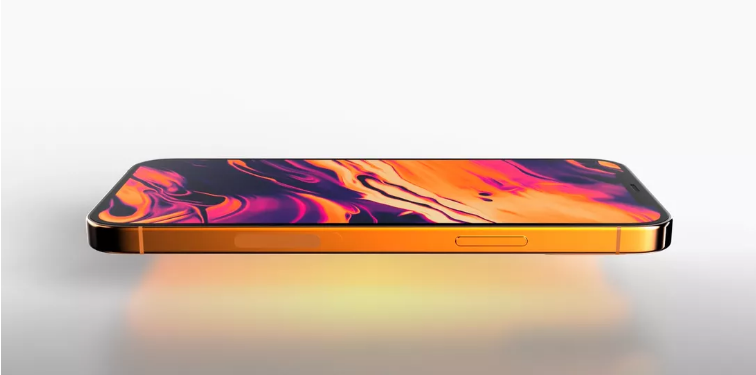

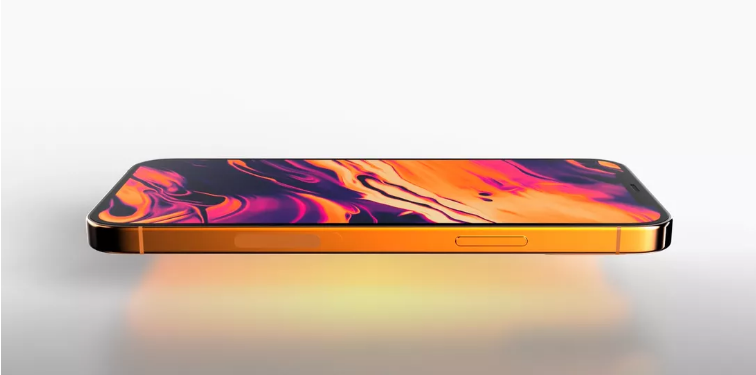

As you begin to plan your photos, don’t forget the small stuff. You want to think of shadows and lighting, dirt specs, and, especially, the composition. If you are photographing a computer, tablet, phone, or TV, remember that the device’s display is an important aesthetic detail. Think of your target audience and what could appeal to them on those displays. It could be a screensaver of other products you sell, your storefront, or alluring copyright-free images from free photo services such as Unsplash, Pixabay, Shutterstock, and Pexels.

Even if social media is not in your marketing plan, you can apply these tips to any kind of marketing photography for print or even eCommerce. No matter the platform, improving your photo strategy will help get your products and stores noticed, with sales to follow.

3D COMMERCE

How to Optimize your Digital Showroom

Nine tips for enriching your online product content

to drive e-commerce success.

BY LLOYD WOOD – Senior Manager of Online Account Sales at GfK Etilize, the world’s largest product content syndicator. He can be reached at lloyd.wood@gfk.com.

It would be tough to overestimate the impact 2020 had on e-commerce. As in-store shopping became nothing short of dangerous, consumers began experimenting with and adopting a host of e-commerce options — from “traditional” delivery to click-and-collect and other modes. Necessity became the mother of adaptation, forcing people out of their shells, and empowering them as savvy online shoppers.

Consider this: online sales accounted for all U.S.-based sales increases last year — a jaw-dropping development. Digital Commerce 360 estimates that, in 2020 alone, U.S. online shopping increased about $174 billion, to over $861 billion. And globally, e-commerce sales are up to $26.7 trillion, according to UN Economist, with over one in four transactions occurring online.

For brands — including those in the electronics space — this acceleration to online buying had huge implications. The chances that someone would go to a store to view a product, and maybe even buy it there, dropped precipitously. Ecommerce SKU listings became the only window shoppers had onto the items they planned to buy, making this information even more crucial.

Many electronics brands devote substantial resources to developing online product content — but there are plenty of opportunities for doing better. And, as they have become more sophisticated about online shopping, consumers have come to expect more from product content. To succeed with today’s B2B and B2C shoppers, content needs to be robust, easy to find, answer shoppers’ questions, and leverage a responsive format to enable shopping on any device — from desktops and laptops to tablets to smartphones.

At the same time, leading marketplaces have increasingly required product content — which can include well-written titles, bullet points, high-resolution images, videos, attributes, marketing text, and more — to enable a better shopping experience and to win over buyers in their hyper-competitive marketplaces. Sites such as Amazon, NewEgg, Overstock, Rakuten, and Walmart insist on good search and attribution to gain customers.

So how can brands become masters of this newly demanding digital content space, growing e-commerce revenue and setting themselves up for ongoing success?

1. Complete titles

Complete titles are the cornerstone of product content and should include the brand or manufacturer’s name, the manufacturer’s part number (MPN), and applicable attribute values — size, color, and more — while making full use of character limits. Having titles that are normalized also leads to a more consistent and optimized shopping experience. In addition, titles should be tailored for the intended audience; a B2B buyer expects a different title from a B2C buyer.

2. Bullet points

Online buying decisions are often made on bullet points and reviews alone. Shoppers expect that the main values and functionality will be defined in easy-to-consume bullets that are generally located immediately under the product title. The content of bullet points should change based on the category and in general be normalized within a category. For example, the bullet points for TVs should contain screen size, resolution, screen type, mount type, supports standards, and any other features. Icons are often used to further communicate product features.

3. Images and rich content elements

Depicting your products with as much completeness and clarity as possible is a must. Images should include a leading main image (“hero image”), left, right, rear, and lifestyle images, plus “What’s in the box” and special features. Large images engage the buyer and quickly tell the product’s story; they must be at least 1,000 x 1,000 pixels at 72 DPI; however, 3,000 x 3,000-pixel images are preferred. Rich content can include product images, lifestyle images, 360 views, videos, and unstructured/A+ content.

Many well-known e-commerce platforms show 10 or more images, and leading brands fill them all. In addition, product videos are now mainstream and a key component to higher conversion rates. Videos can be series level or product-specific and should be well-produced, short, to the point, and shown in a responsive frame for viewing on any device. Having installation, family, series, and instruction manuals available for download also leads to an optimal shopping experience.

4. Optimized image resolution

It is imperative that images display quickly on websites; slow resolving can lead shoppers to look elsewhere. Image delivery times of 300 to 500 MS are generally accepted to be “instant” on shopping sites and can be achieved with global content delivery networks (CDNs). This technology uses cached images globally so that a server is close to any shopper, resulting in pictures quickly loading.

5. A+, or rich content

Brands and manufacturers have discovered that A+, or rich content, increases conversion rates by three percent to 10 percent. This unstructured content tells a product’s story in a concise, complete, on-brand, and responsive way, delivering a more fully immersive experience that the brand can control on its channel partner sites.

A+, or rich content, is most often delivered through web services, which is a call to an image server so that the final product is consistent and reflects the brand’s priorities. Having A+/rich content delivered from a single source ensures consistency and a uniform brand experience. This feature also enables quick updates as a product goes through its lifecycle.

6. Normalized product attributes

Normalized content is a database term that means that product content for a given category has uniform data. Normalized attributes contain factual information such as size, speed, color, manufacturer data, weight, and factual data about the product. With normalized content, the attribution is based on category-level templates and can vary from a few dozen to 100-plus for complex products, such as servers. Attribution is one element that drives search and is often used in product comparisons. Products that have normalized attribution across categories allow for comparisons in which all the product’s specifications can be viewed against other products within the same category, regardless of brands. Product comparisons are a good way to engage buyers, leading to increased conversion rates.

Brands rely on data providers to create and update taxonomies that enable normalization. A taxonomy is a set of data for a given category; a laptop’s taxonomy, for example, would include screen size, weight, memory, brand, and many other values. A leading taxonomy can have as many as five “leaf levels” to enable use of more relevant data values and avoid mashing together products into a single category. A top-level taxonomy can be broad, such as all computers, and leaf levels would further divide computers to subcategories such as handheld, laptops, desktop, and servers, for example. Taxonomies can change with technology; a healthy taxonomy should be dynamic, as technology and use cases change.

7. Accessories

Leading data providers also include the options and accessories for products, which increases average cart values. Having the proper accessories would include the products a buyer may want or need, as well as warranties, service contracts, and seat licenses — extremely important in B2B sales, where multiple components are often required for a working system.

8. Localization

As e-commerce grows, so do the audiences, which requires multiple languages and localization for different customer bases in the same or other countries. This is another advantage of a data provider that delivers robust and multilevel taxonomies; they are more easily localized, which is becoming a requirement in the growing e-commerce world. Localized data is in the language and measurement system in use for the designated audience. For example, localization in the U.S. may include content in English and Spanish. Localization in Germany would include German and English language and metric measurements.

9. Product finders

Product finders enable a guided shopping experience based on a buyer’s requirements and can increase the speed at which decisions are made. A buyer can quickly determine which product(s) meet their requirements by deciding on required features from dropdown menus. Better finders also include price and availability to ensure an optimal experience and increased sales. A well implemented Product Finder improves the shopper’s experience and buying experience while increasing sales.

The art and science of online product content have been evolving over decades, and they are rising to meet the challenges of today’s demanding shoppers. But brands need to understand and leverage the many content options available and continue to update and innovate with their listings. Putting a product’s best foot forward online has never been more important, and the right syndication partner will bring you much closer to continued success in this highly competitive game.

POWERFUL WOMEN IN CONSUMER TECH 2021

Team Leaders in Tech

Nominated by their peers in the industry, this year’s honorees share their insights and prescriptions for advancing women in the industry.

This annual Dealerscope program is designed to acknowledge the contributions of women to the progression and betterment of the consumer technology business — and never have their contributions resonated as deeply as in the last year and a half, with the onset of a world pandemic and, more pointedly, its impact on our industry, its products (because of supply-chain issues and chip shortages), and its vendors and retailers.

These women have shown that they have what it takes to lead, to rally and mentor others within their business sphere, and to help move the consumer tech industry forward even as it is beset with headwinds to its progression that were unheard of — and unimagined — just 18 months ago.

Those cited this year include both Powerful Women honorees, and a group we’ve dubbed as Women on the Rise, whom we acknowledge as individuals to track as they pursue their paths in consumer tech.

We asked each of them three questions:

- What attracted you to a career in consumer technology?

- What makes consumer technology a good career choice now for women?

- What hurdles remain for women to overcome in the CE industry?

Read their answers on the following pages. We think you’ll find learning about what attracted them to our industry, and where they see the trajectory of women’s roles in it, as illuminating and inspiring as we did.

Dealerscope congratulates all our 2021 honorees.

Lisa Akers

Vice President

The NPD Group

As a member of NPD’s technology sector, I value having the opportunity to work with companies that are impacting change in people’s lives through innovation and disruption. In this ever-changing industry, the products that our clients create, market, and sell contribute to the culture of society and define generations. It is exciting to be a part of an industry that continually pushes to evolve, through competition and innovation, with the goal of enhancing lives through connection, entertainment, and productivity.

Any field that women are passionate or excited about is a good career choice. Women are consumers, users, and influencers of consumer technology products. A career path that allows women to utilize their skillsets and contribute to a company’s growth or innovation should be celebrated. The technology industry needs innovators, marketers, and leaders to continue to drive the industry forward and make products with features and value propositions that appeal to all.

All women should be encouraged as consumers of technology to research and understand the products they are buying, including the components and features as they relate to price and value. Being an informed consumer leads to interest and involvement, resulting in opportunities for women to take on more roles in technology-based companies. In my role, I work alongside many talented and smart women, including those at my company (NPD) and the clients we support. The biggest hurdle I see for women is not the limitations of the technology industry, it is working in a corporate environment balancing family priorities and obligations. I am encouraged by the changes I’ve noticed over the years from corporate America as a whole, and proud of the support my company provides to encourage this balance, which is important because the current generation of children are the future innovators, leaders, and consumers of the technology industry.

Katye McGregor Bennett

CEO

KMB Communications

I fell in love with car audio in my teens and have been drawn to audio, video, and technology ever since, but I’m also very much attracted to design and how the two can coexist cohesively in a space. It’s the combination of tech and design, though, where I’ve found the most joy, and also where I see significant opportunity for others. In my opinion, while the functional intersection of design and technology is still in its infancy, consumers are keenly aware of what they want and how they expect it to be different. As such, brands need to evolve (quickly) to meet consumers where they are. But, how do they get there? What does that look and feel like? Who has those resources to help make that happen?

There is ample opportunity for women or anyone who’s able to interpret and communicate the language of AV in a more digestible and engaging manner to get into the industry and make a valuable contribution, to rise through the ranks, and carve their career path as they wish.

Amy Croom

Director

Public Relations & Communications

Nationwide Marketing Group

Today’s consumers aren’t swayed by facts and figures alone. Instead, they want to understand how the products they purchase will impact and improve their lives. As a storyteller, I love having the opportunity to make those connections and bring the “why” of consumer technology to life.

Although the channel has traditionally been very male-dominated, women’s purchasing power and influence make them a critical demographic for manufacturers and retailers alike. Which means women’s opinions should be — and are — increasingly sought after with regard to every aspect of consumer tech development, from UI and UX to aesthetic design, packaging, merchandising, delivery, and install. The major challenge to participating in these conversations, though, is the knowledge that the opportunities exist at all.

The rise of STEM curriculums in schools has helped broaden horizons, but it is incumbent for all women within the channel to share their consumer tech passions and experiences with younger girls to start nurturing the next generation of female consumer tech leaders.

Jill Escol

VP and Global Director

PAC Marketing and Communications Premium Audio Company (PAC)

I have always been fulfilled by spreading the word about Klipsch products because people have an emotional connection to them. I am attracted to the familiar culture among our employees and customers. Together, we work hard, have fun, and take pride in making products that improve lives by entertaining people, bringing them joy or providing an escape.

Consumer technology is a good career choice for women because technology is interwoven into people’s daily lives, regardless of gender. As an entire generation is set to retire soon, women can help shape the industry by providing a unique perspective into the largely untapped market of making products that appeal to and are marketed to women.

Hurdles for women in consumer technology include being heard, respected, and closing the gender pay gap. It is important to mentor women and empower them to contribute to and lead the industry for future generations to come.

Elizabeth Gazda

CEO

Embr Labs

I have always been attracted to consumer electronics as the most fluid way that technological advancement can be made available to the everyday person. However, the more I started to examine the design and communication around electronics, I was struck with how much more could be done to explain how things work and improve consumer interaction (just think about the complexity of the basic TV remote control). As I thought about the fact that most consumer products are designed by men, I became interested in how the user experience might shift if more women were involved in design, engineering, interactions, and user communication. At Embr Labs, bringing this diversity of thought to everything we do is critical to our success and to help ensure that our products are loved by ALL types of consumers.

In light of this opportunity, consumer electronics is a great career for women. Women are keen observers of social behavior and trends, and are able to bring that tacit knowledge into product development. Today, women are seen as the “Chief Purchasing Officers” of their families and are responsible for 85 percent of all consumer purchasing, which accounts for $7 trillion in consumer and business spending — so women need to be at the table when deciding how to build and market consumer electronics.

Barriers do remain for women in consumer electronics. Many of the traditional engineering and leadership roles are still dominated by men, but the industry is slowly waking up to the benefits of diversity in design. When it comes to innovation, one of my favorite quotes that captures the value of diverse thinking is from George S. Patton: “If everyone is thinking alike, then no one is thinking.”

Danielle Feldman Karr

Director of Marketing

Snap One

I truly enjoy the creativity and innovation found in the consumer technology space; that is what initially attracted me to the industry, and that plus the amazing people in this industry are what has kept me here.

Now more than ever, the unique perspectives that many women bring regarding lifestyle and usage of technology in the home is invaluable. I have seen firsthand at my own company the powerful growth that comes from diverse perspectives being welcomed and respected, and I know this focus on inclusion and care is a growing trend throughout the industry.

While there are still hurdles for women to overcome regarding representation in the space, the opportunity to make a positive impact in this industry as it evolves, as well as to empower and help people through everyday home technology, makes now an exciting time to be in — or join! — the CT industry.

Haley Patterson

Director of Marketing

Access Networks/Snap One

I’ve always said that consumer technology found me, and I’m so glad it did! Right out of college, I was a girl with a dream of living in California and working for a startup company; the company that made that a reality was PRIMA Cinema. I realized very quickly that this was an industry that I wanted to be a part of for the long haul. Not only is consumer technology fast-paced, ever-evolving and arguably one of the most essential parts of our daily lives, but it’s an industry full of passionate, incredibly talented individuals. A woman’s perspective in this industry, and every industry, for that matter, is important. If you are passionate about consumer technology and making a difference in the space, there are a ton of interesting companies and opportunities.

Women in the workforce still face inequality in many ways, but with every generation, we close the gap a little bit more. My advice to women entering consumer tech is to always be curious, stay true to what makes you happy, speak up, and lean on other women (like me!) to support you.

Jennifer Walcott

Vice President of Marketing

D&H Distributing

Technology is always exciting because it’s one of the most rapidly changing sectors you can find, and I’ve always thrived on that energy. Especially with a company like D&H, where their history goes back to some of the first televisions, the first computers, the first video game systems that were ever on the market. The industry has evolved now to where the lines are blurred between when we’re working and when we’re “home;” it’s changed how we work and play. It will continue to change how women are able to engage in high-tech careers, making it a more amenable environment no matter what your gender.

A recent stat shows that “Women direct 83 percent of all consumption in the United States in buying power and influence” (Catalyst). Women bring a vital voice and perspective to the consumer technology industry both as executives and as a driving force in decision-making when it comes to technology purchases for the household. As more needs within the home have been taken over by technology, whether it’s automated thermostats and blinds, to Alexa-based appliances, to home security, to streaming of entertainment media, there’s that much more reason for women to contribute their point of view to the development, marketing, and sales of these products.

Technology has created a new emphasis on seamless collaboration from anywhere, which has eliminated some traditional obstacles to creating an acceptable work/life balance. Women should strive for being part of a company that not only values their input and their skills and talents, but that considers people’s individual needs and creates an atmosphere of support and respect. Flexibility in the workplace is key. D&H, for example, has an enviable company culture, where employees can trade or “donate” paid days off, family activities are greatly encouraged, and creative input from the team is welcome at any level.

Gina Sansivero

VP of Marketing & Corp. Communications

Atlas IED

Like many of us, I think the technology industry found me. I was working in marketing at a successful medical components supplier, and was looking for a new challenge and a new industry. The appeal of an ever-changing, ever-innovating industry, like CE, was strong from the beginning. So, I took the leap and never looked back. I don’t know I would want to be anywhere else at this point in my career.

Consumer technology, like many tech fields, lacks diversity. One aspect of expanding DEI initiatives in the industry which I am very passionate about is increasing the number of women in leadership positions. Many companies in CE would benefit from different experiences, viewpoints, and problem-solving skills that women offer. This diversity of thought makes us stronger and more nimble.

Undeniably, there are fewer women in CE. As a result, it’s easy for a woman to be intimidated by a profession or industry in which she cannot “see” herself. Advancing women in the industry, specifically into leadership positions and making women more visible (for example, this Dealerscope list) will help to recruit new women.

WOMEN ON THE RISE 2021

Miranda Grantham, National Sales Manager, Origin Acoustics

Starting in this industry at just 22 years old, I have been completely enamored with the fast-paced world of technology. I have a deep appreciation for custom integration and very much enjoy working with dealers to co-create awe-inspiring spaces! The consumer technology industry is an excellent place for women, as women tend to have great attention to detail and can contribute to building spaces that remain cutting edge, while also being aesthetically pleasing. Women play a key role in providing a different perspective as to how the entire family utilizes their smart spaces!

Ashley McCann, Director, Audio Analyst, The NPD Group

I’m pretty nerdy, but also love sports. It was clear at a young age that I wasn’t destined to be a professional athlete, but a career in technology was a natural fit. Plus, that’s where the action is. The technology industry is constantly evolving so there’s always something new and interesting to talk about. In my role as an analyst at The NPD Group, I get to work with many of the largest players in the audio industry while also geeking out and telling stories with data that help inform their business decisions.

Tech products aren’t gender-specific. They need to appeal to and work for everybody, so it’s really important to have a diverse set of ideas and opinions represented on every team. While great progress is being made, women are still a bit outnumbered in some segments of the technology industry, but I don’t see this as a reason for women to be intimidated by consumer tech. I have had the pleasure of working with a lot of really intelligent women, both internally at NPD and externally with our clients, partners, and beyond, who I think would agree that a career in CE has been a great choice.

Fortunately, I think we are at a point where there aren’t many major hurdles for women in consumer electronics. With a focus on STEM starting very early, women should feel comfortable joining any industry of interest, especially consumer technology and/or data analytics. It’s important to be confident in your own knowledge and skillset.

Kat Wheeler, Area Sales Manager, Snap One

I fell into my first role in the industry completely by accident. I quickly fell in love with the people and the technology and I’ve been proud to be a part of it ever since. What made me stay in this career was the technology and the people. What we do is never boring. Our products and services are constantly evolving and it makes every day a new and interesting challenge. This is also the most supportive and welcoming community of people I’ve ever known. I’m so lucky to have made friendships here that will last a lifetime and I’m grateful every day to have been able to learn from some exceptionally smart people. While the technology may pull you in, it’s the friends, teammates, and mentors that will make you stay.

Two words [apply to this industry]: opportunity and growth. There are countless opportunities available for women in our industry in both technical and non-technical roles and the resources for personal and professional development offered by our community is second to none.

Our industry is growing at an exponential rate. The adoption of technology in both the home and commercial environments has never been greater. This is not only exciting and fun to be a part of but will insure there are only more and greater opportunities for us in the future.

I think we’ve come such a long way in the time I’ve been a part of the industry. While I think discrimination still exists, the community we’ve built has made those instances fewer and farther between. When I first started, there were far fewer women involved, especially in technical roles. Now there are so many women owners, women in engineering, women in tech support, and women in sales roles. There are also Women industry groups like the Avixa Women’s Council, Women in Consumer Technology, AV Yoga, and so many more. The opportunities provided and the community it brings together make this a stronger, more welcoming place for everyone. The support and encouragement offered is really inspiring. I wish I’d had those resources available to me when I first started out.

DISTRIBUTOR ROUNDUP

Strategies

that Empower Retailers

How CE and appliance distributors are surmounting challenges to their abilities to support the dealers they serve, head on.

COMPILED BY NANCY KLOSEK

How would you summarize the effects of the past 18 months on your business as a distributor (specifically mentioning any of the direct and indirect factors involved — the overall pandemic, the ensuing chip shortages, effects on consumer buying patterns, etc.) — and in what ways is your company adjusting the programs and policies it offers dealers to help them stabilize and grow their businesses through this unsettling period?

21st Century Distributing |

Tyler Nelson, Director, Marketing/Training

21st Century Distributing has been very cognizant of all the challenges in the CE industry over the past 18 months, and has maintained an attitude of offering not only the best in customer service and expanded product offerings but also educational opportunities to help our dealers achieve their absolute best in these uncertain times. We’ve secured a 24-hour non-contact and curbside pickup service at all our locations, upgraded our servers and online POS systems, and will be hosting our annual dealer event fully virtual for the second year in a row. This event provides our dealers a chance to increase not only their product knowledge but overall business acumen. 21st Century Distributing is looking towards the future by helping our dealers navigate these uncertain times, through education and adaptation of new business opportunities like commercial installations and technologies like fiber.

Almo Corp. |

Jack Halperin, Senior Vice President,

Dealer Channel Sales

Consumer demand has remained solid. Aside from diligently working to keep our staff and dealers healthy through the maintenance of safe selling protocols, supply chain has consistently been the biggest obstacle. Our Number One focus continues to be leveraging for sufficient inventory, securing incoming schedules from the manufacturers, and receiving goods in timely, cost-effective fashion.

Even through all the supply-chain challenges, it’s important to keep things in perspective. Most of our dealers’ performances this year, with the aggregate brands we represent, are tracking well ahead of CY19 and even recording-breaking CY20 levels. While always part of our core value proposition, we’re working harder than ever today to help our dealers grow and prosper during this unprecedented time within our industry.

Catalyst AV |

Helge Fischer, Executive Director

What an unsettling time! Catalyst AV members and their dealers have experienced a very strong growth cycle in their businesses.

The biggest issues have been getting merchandise such as AV receivers. Through this, we have been encouraging our members to have enhanced websites, multiple pickup locations and offering their dealers site surveys and presentations for end users. They are also offering extensive system design and proposal assistance for their dealers.

Instead of the typical “classroom” trainings, our members are rolling out more “trade show” style [trainings], with a time window of several hours. This has worked really well and separated visitors. Online training webinars are successful, with AVPro Edge, Cleerline, LG and Eero; [they are] recorded and put on their websites for those that cannot attend.

There will continue to be COVID problems, so networking products will have strong growth. Again, great opportunities for our Catalyst AV members and dealers.

After having rapidly accommodating to dealer needs with a slew of new distribution solutions at the pandemic’s start in early 2020, distributors are now having to double down anew with fresh and creative business approaches in the face of the COVID variant, as they strive to help retailers shepherd their businesses through 2021 and successfully into 2022. Those who have been most successful to date have shown impressive responsiveness, along with a good measure of common sense and true empathy for dealers, as long-held relationships with both manufacturers and dealer clients are being tested as never before.

Climatic Home Products |

Doug Allen, President

The COVID pandemic immediately caused stress on the appliance industry in April 2020. Later in 2020, the industry had significant increases in kitchen packages. The changing of consumer spending from entertainment and vacations to home remodeling and buying new homes fueled this demand.

Just as we have had some categories catch up, we will see other product categories reach their peaks before others. We know there are shortages of chips and constraints in logistics in our industry. With these issues, we will continue to see many Mass Premium and Luxury brands that use chips in their products continue to struggle to catch up with or meet the industry’s demands.

In the last 18 months, Climatic Home Products has been able to deliver appliances to our dealers by being able to allocate high-demand products, advising dealers on what’s next, and [having] the ability to ship products from out of zone warehouses with minimal cost to the dealers.

D&H Distributing |

Trevor May, Vice President of Retail Sales

Despite the challenges in the marketplace, D&H has seen its retail business continue to grow. Shoppers are returning to retail storefronts, but research shows they are still looking for the same options they became comfortable with during the pandemic, such as curbside pickup and expanded online inventories. D&H has helped partners fulfill these trends and meet growing needs in areas like remote learning and work-from-home networks, esports, smart home automation, and pro AV. Even with shortages still lingering in certain areas, D&H will continue to offer best-in-class products, logistics, and expertise to help these customers attain ongoing success.

DAS Companies, Inc. |

Rex Berfield, National Sales Manager

This pandemic has illustrated the importance of “the relationship” in regard to account management, sales, and service. Everyone is facing the same issues; we have used this opportunity to focus on what we can affect and improve.

We understood the importance of in-person visits. The value of human contact for industry news and updates, business trends and insights, and the moral support of talking in-person has proved dividends for us.

Additionally, we recognized very early that this pandemic would impact everyone very long term. We immediately implemented an allocation strategy equalizing product distribution to help all our business partners, large and small, stay in business. Our Number One goal is to keep everyone’s business going during these times.

Exertis North America |

Jeff Willis, Senior Vice President

of Product Management

We had to pivot to help resellers focus on the types of products and solutions needed as the pandemic evolved and work from home became broader to include “work from anywhere and everywhere.” We also helped manufacturers adjust their supply chains to gain a higher level of visibility into the pipeline to see all the way through to the end user. Our partners relied upon us for the real-time understanding as to which projects were still in play, which were going to be able to close and when product was needed for those projects.

We offer programs that are successful for our partners; although many were delivered virtually, it was important keep offering these programs. Being a global distributor allows us access to unique capabilities and funding streams. We are also transparent with our customers regarding supply-chain availability and all that we are doing together to help their business.

The Fesco Group |

Raymond Levy, COO

There was a huge shift in what and where people purchase. Our goal is always to be a turnkey solution for our retailers. We realized, as diversified as we were, that we needed to further diversify our product categories so that we meet our customers’ various and changing needs. We added private brands, licenses and distributor brands in multiple categories. We’ve also moved into engineering and designing cutting-edge products.

The infamous chip shortages have contributed to an increase in prices. Plus, stimulus money has caused a significant increase in demand for consumer goods and triggered freight rates to rise fivefold and sixfold. With the pent-up demand, sales units have slowed a bit, but sales dollars seem to be flat or better.

Ingram Micro |

Alexandra Harding, Director, Vendor Management,

Business and Consumer Solutions

To say that the past 18 months have been interesting is an understatement. We have learned a lot about how resilient our associates are and their ability to pivot quickly has been amazing. Giving our associates the support and tools needed to enable our partners to have continued success is key. Understating our partners’ needs and business is critical, as not all needs are the same. We offer our partners a wide variety of solutions from product availability and warehousing programs to creative financial solutions. These are just some of the tools that Ingram Micro has to offer. Being creative during these times is a must.

New Age Electronics |

Fred Towns, President

We have experienced ongoing challenges within the supply chain, as have most companies in the industry. Though we see some improvement, we expect this to continue through the holiday buying season and beyond. Chip and glass shortages, specifically, are impacting many of our brands. With the pandemic continuing, we continue to work daily with manufacturers as they seek to return to pre-pandemic output levels.

Despite these challenges, New Age Electronics continues to bring innovative products and new solutions to market. We are working with dealers to find solutions to maintain availability and additional options that satisfy the consumer on constrained product areas where possible. While customers want to shop and seek in-store experiences that afford them the opportunity to see and touch products, we are also working with our dealers to build a more robust online presence.

Next Level Distribution |

Jonathan Elster, CEO

Since COVID hit, we wanted first to keep our employees safe. Protocols were put in place, and several worked remotely. But our job was to continue shipping products needed in these times. We set up curbside delivery, and used our own trucks for same-day delivery. We’d always been big about getting in front of customers with training, and that changed to virtual training and virtual Zoom visits. COVID has obviously affected inventory with continued constraints, but we’ve been able to bring in additional product, when we saw things getting tight. Certain categories are still challenging like car audio and AV receivers, but we’re hoping that in Q4 things open up a bit. We’ve gotten closer to our customers as a company, via Zoom and other ways. When vaccines started rolling out we were back in front of customers, but with the Delta variant, we slowed it down to protect customers and employees. We have managed from Day One to keep our team together and drive our culture with cool things like our monthly Book Club to keep up our camaraderie. The most important thing is people; we’re all about collaboration.

For any customers who initially had cash flow issues, we offered extended terms and credit; we also provide just-in-time inventory and 24-hour pickup in all seven locations, and brought product to customers who couldn’t get to us. We did virtual trainings and enhanced the website to make sure they were getting the support they were used to.

We have incredible customers, and we’re out there, always looking for inventory to make sure we can support them.

Petra |

Tate Morgan, President

As a distributor, it is our responsibility to offer the right products to our customers at the right time. Listening to our customers, we were able to utilize our supply-chain logistics expertise to pivot our operations and fulfill their changing needs. At the onset of the pandemic, our merchandising team acted quickly to identify and secure critical products from key suppliers — including onboarding crucial PPE supplies and shifting to support work-from-home product offerings. Additionally, Petra’s marketing efforts both online and through our digital email campaigns surfaced product assortments tailored to the new challenges the market faced. Our goal is always to provide the right products and insights to support our customers no matter the circumstances.

PowerHouse Alliance |

Dennis Holzer, Executive Director

The past 18 months have both positively and negatively impacted business for the PowerHouse Alliance distributor members. Our members have seen a high demand for products across the display, AV, networking, and security categories as consumers focus on home upgrades and home safety. Supply-chain issues and chip shortages have prevented manufacturers from getting certain products to dealers, making the role of the PowerHouse distributors more important than ever.

The PowerHouse Alliance distributor members have stepped up to become resources for new and existing dealers as they grow their businesses. With PowerHouse new member locations and larger locations opening across the country, dealers have easy access to all product categories they need to succeed. In addition, our recent partnership with CEDIA to bring in-person trainings to all PowerHouse locations will help dealers succeed, as they’ll be equipped with the skills they need to succeed in the industry.

Snap One |

Wally Whinna, Senior Vice President

Business continues to trend positively from a revenue growth standpoint. As a result of decreased travel and more restrictions at entertainment venues, customers are interested in better in-home entertainment. Additionally, the shift to remote work and school has driven demand for upgraded network performance. Simultaneously, chip shortages, labor availability, COVID’s impact on overseas production, shipping availability and cost are all playing a role in price increases and constrained inventory. Snap One proprietary brands committed early to higher inventory levels and as a result, have generally been in a better stock position than some competitive products. Additionally, we have been consulting with and educating our customers on alternatives to products that are extremely constrained, so they can continue to deliver quality products in a timely manner.

SUMMARY:

- The COVID crisis has prompted distributors to dive deep into their think-tank wells more than once for ways to bolster their support of dealers in this unusually prolonged pandemic period, with its unexpected twists and turns. They must work to simultaneously juggle unpredictable external business fluctuations with the internal machinations of running a company, in what has arguably been the most daunting period in a century.

- Distributors are more reliant than ever before on mutual support and collaboration between themselves and their retail clients — and on their vendors who are, in turn, dealing with chip shortages — as the consumer technology industry faces Round Two of COVID-19, the challenge of the Delta variant, and all the unknowns attached to an ever-changing business and societal landscape.

- Supply-chain logistics and product allocation strategies are constantly being fine-tuned by distributors to keep them closely aligned with dealer requirements, and with consumers’ work-from-home needs, as the pandemic moves into new phases.

Q&A

Retail at the Ready

Top members of BrandSource senior management

discuss the buying group’s new tools for HR

and seamless omnichannel retail.

While in Nashville at the BrandSource 2021 convention, we sat down, in person, with the buying group’s CEO, Jim Ristow, CMO John White, COO Dave Meekings, and President Tom Bennett. Earlier in the conference, members of this senior management team had unveiled HR Source, a new initiative to help members recruit, hire, and retain employees, and The Hub, a new user-friendly integrated commerce platform aimed at simplifying and unifying the various elements of omnichannel retail scenarios.

Your last in-person event was in March 2020. What were the main topics discussed then compared to this week’s conference?

BrandSource CEO Jim Ristow

Jim Ristow (JR): It was kind of unique in that we’ve been on a mission for almost four years now to bring our members to the forefront as far as digital marketing, website, and eCommerce is concerned. And our message at that event was: This is the way the market is going to be in the future. But our future was probably three to four years out. And we had been pushing them and pulling them and trying to get them there. In March 2020, the day we closed the show floor was the day that the country shut down, just as we were flying home, so thank goodness we had gotten so many to that place already, and others had just heard the message, because a few weeks after that, stores were closed. Of course, you never want anything like COVID to happen, but the timing of the messaging was fortuitous.

Did the work-from-home element of your organization, coupled with the revolution in retailing, accelerate the development process of your new digital tools like The Hub?

BrandSource CMO John White

John White (JW): It’s easy to be open to it, but we didn’t really have a choice. If you go back to April of 2020 and your store’s closed; if you were going to do business, you had to do it online, so there were a lot of things that happened really quickly, whether you wanted them to or not. And sometimes when you don’t have a choice, it’s easier to adopt new ideas, and I think our members learned a lot from that experience. In terms of tools in general, we generally take the approach that we’re going to do whatever it is for our members. We just need their buy-in and acceptance and their help with whatever it is.

JR: COVID was the great accelerator; it took a three-to-four-year cycle, and within weeks, it became today. We had to do it. And so two things happened: We reprioritized our roadmaps inside the technology company in a matter of days — literally — so that things that were going to be way out were going to need to be done sooner because the members needed them right away. These guys got it done; I don’t even know how. And so, also, in reconfiguring what was important, it allowed what was to have been a four-year project [to change] into a two-year project that they’ve been able to implement now.

JW: A lot of the reprioritization of the things that were on the roadmap were more focused on how you communicate with your customers differently, because that was the expectation, and the only way to do it was with more credit card processing options and anything that was focused on actual selling out that day. The things that fell by the wayside might have been back-end stuff, systematic improvements, or the way a dealer or retailer might interact with their system versus the way a consumer would. Anything that would help physically drive business went right to the front of the line, and that’s what we worked on.

Plus, you had your users providing needs and feedback in real time.

JR: Our unique claim to fame is summed up in a phrase we use: built by members, for members. We don’t do this in a vacuum; we actually have members that are part of the process from Day One of whiteboarding, to mid-build, to go-live phases. So that also gives us two unique things: It lessens the need to pivot or make changes, though that’s necessary anyway, no matter what, but this greatly decreases that. The second thing is that we are so focused and narrow on what we’re able to produce…

You announced HR Source yesterday. Are the members jazzed about it?

BrandSource COO Jim Meekings

Dave Meekings (DM): Yeah, I think they’re excited about it, especially since it’s typically something that doesn’t get a lot of forefront attention. The reactions have been good from a recruiting perspective, a hiring perspective, and a handbook perspective. Just having the security of the handbook — our members are very engaged with it, more than we even thought. We knew it was something they needed, but now they realize that they need it right now, and they’re reacting very positively.

JR: The different profiles and sizes of dealers that were interested in HR Source were a surprise. We thought this might be for our more mainstream types of members, but even our most progressive and largest members were interested. That part actually exceeded my expectation.

It was refreshing to see HR — employees — at the center of your announcements. What prompted the focus on HR?

JR: In a normal company, the shareholders are who you report to. You have to give value to them, you have to meet their market needs. We’re set up as a co-op. Our members — the dealers — we have to solve their problems. So we literally meet monthly with a roadmap of problems, and then resolutions. We started working on this months ago, and were able to roll it out for the show.

BrandSource President Tom Bennett

Tom Bennett: During the pandemic, we started [doing] calls and we were doing them every other week with our GM of Merchandising Chad Evans and a bunch of the members of the team. We did them over Zoom so that the members, by region, could call in and, for lack of a better term, vent and talk about what was going on. And these HR topics kept being brought up again and again, like, we’re having a hard time with rules and safety and guidelines and workbooks and now I can’t hire people, how do I hire people… and how are you finding people? We didn’t come up with the idea; we listened to our members, kept taking notes, and realized that this thing wasn’t going away. This is a real problem that we’re going to have to solve and invest some assets into, to try and fix it.

The other obvious issue that retailers in every sector are having is inventory. How is BrandSource addressing this issue for its members?

JR: If you remember from our keynote, we try to focus on two things for our members: information and MarTech. Since the pandemic hit, we’ve focused like a laser on giving our members the right information, and we didn’t do it in just one format. Tom just gave an example of one, but we go everywhere: We have YourSource news in an online format that’s live, we have newsletters that go out, we have fax blasts that go out that are just as specific as the online news and vendor blasts. And then we have the two-way formats that Tom was talking about. Besides facilitating member-to-member Zoom calls, we put a team in place to make one-on-one calls with our members to see if there was anything that was needed.

DM: We had about 15,000 conversations with members. Then on top of that, we are now focusing on certain areas, so we’ll have groups of members get together just to tackle service issues, or just on the furniture channel. And what we’ve launched here is getting people to sign up for the HR and staffing issues. We’re building these communities within the BrandSource community, which really allows our members to help their businesses on things like HR, which they don’t really have a lot of time to manage. We give them the tools to be as competitive as anyone else, and help scale that up for them.

In terms of marketing and advertising, which channels are growing the most?

JW: I’d say the biggest growth is probably social. Facebook advertising is still growing like crazy; then I would say next is probably OTT (over-the-top) — so, advertising on streaming TV and on any number of platforms such as Hulu. Conversion rates on OTT are significantly different. More than half the population doesn’t have cable any more and is on OTT. Unlike with traditional broad match TV advertising, where you run the ad to everyone that lives in the town, with OTT, you can target intenders, so only people who have looked at something in your category. So from a cost perspective, it’s super-efficient. And just the fact that with OTT, you can target intenders… normally, when you’re doing TV advertising, you’re running the ad to everybody that lives in the town, right? Well, if you look at OTT, you’re only targeting people that have looked at something in your category, so you can truly target versus broad match TV. And it’s also not skippable, but you can click through on it. So, from a cost perspective, it’s super-efficient, comparatively speaking.

What about data and privacy around not only targeted advertising, but also transactions?

JW: If we were pre-pandemic I would have said that our members needed to hurry on being up to date with data and privacy protocols because it was coming faster, but then you throw governments in and a lot of other things that are priorities right now and it’s slowed down in terms of how fast privacy was coming. In general, though, even though that stuff has slowed down, I think it’s still important for dealers to think about it. And not just privacy, but also the security in their systems, given all of the hacking that’s going on. Most of the privacy stuff, we handle for them. If you physically purchase from a retailer, you have no assumption of privacy because you have to give your name to get the delivery, and all those things are normal. It’s the web stuff, where you’re collecting and where you’re sharing that data across to other parties that are unknown. But we handle most of that for them, so it’s pretty straightforward. It’s mainly making them aware.

What’s cool about The Hub?

JW: I think if you look at our space, regardless of the category, the retail sales floor is the only thing that has never really changed. It’s more or less the same today as it was in the ’70s: a salesperson greets the customer at the door, walks them around, shows them products, writes it down, goes to a cash register, and then rings it up in one way, shape, or form. But as consumers have gotten more sophisticated with the types of products they buy, they want more information about it. Beyond that, frankly, you have to be more efficient because it costs more to be in business these days, and the labor pool is shorter, so it’s not as easy to just hire five more salespeople to handle more customers.

So, some of the inspiration for The Hub came from wanting to make salespeople in stores more efficient, and some of it came from customer expectations of the type of data they want access to about themselves and their shopping history and preferences.

JR: Also, never leaving the customer on the floor.

JW: It’s a frustrating, long process. Buying a car is painful; salespeople play the game of going to the sales manager, all the back and forth, and there’s a little bit of that in the appliance business, too, with “let me go and check to see what we have.” But the current availability issues have made this a lot worse — salespeople might have to get on the phone with the manufacturer to find out about inventory — so we wanted to find a way to get the information and product to the customer faster, so that buying a washer doesn’t take two hours on the floor.

JR: The Hub revolutionizes the sales experience, takes it from then to now. I’m so proud of the development team, not just for building the technology, but for the user interface, which is so simple and so intuitive that the average retail salesperson will adopt this very easily. So that’s on the floor. The other part, as John alluded to, is this — that this whole world of online and in-store become one and the same: Start at home, end in stores, and back and forth; the technology that’s built into this tool to revolutionize that part might even be stronger than the in-store portion. Our online world is our flagship store; the physical store is the second store.

It really to boils down to this: The customer wants to shop how they want, when they want, where they want, right? So we need to have the cleanest, most intuitive system that allows them to buy at any one of those touchpoints, start and finish at any of those touchpoints, and lead in technology in any one of those touchpoints. Some people come into the store for the big-ticket item and go, but there are other people now that feel very comfortable texting and doing a big-ticket transaction on the phone.

DM: We had a furniture town hall with furniture members in there, and the ones that are really succeeding are the ones that have an incredibly legitimate website presence that is transactional and can do everything that any other website can do, but that legitimizes them enough that [consumers] know they can go to that store and see it in person and they’re getting a completely legitimate transaction from a very legitimate company.

JW: I think the other thing is you want to use this technology to figure out ways not to waste the customer’s time. I’m a texter. I text everything and the reason why is because I can truly multitask with texting; on a phone call, you have to listen and you have to talk. Whereas you can send a text message, and when you reply, you can text back in two seconds. But that might not be someone else’s preference. Their preference might be chat, phone, or driving in to the store. You have to figure out a way to make it the best for everybody because everybody has a set of preferences and those preferences are changing fast.

JR: One consumer’s preference might be at 11 p.m., shopping for a kitchen, putting it in their shopping cart, and then walking into the store the next day. The salesperson can pull that up, the customer can look at it, change the color in six seconds, and they’re set. Those specs can be emailed or texted to them. They can go home, talk to their spouse, and with one push of a button, they buy.

What do you see on the horizon for the next 18 months?

JR: I believe chips are going to continue to be an issue, more than maybe even we thought two weeks ago, and not just in our industry. There are a lot of variables and there’s going to be uncertainty between now and the foreseeable future. Whether it’s 12 months or 16 months, it’ll be a significant period of time.

JW: The industry demand is going to continue to be high as long as interest rates are low and money’s cheap. There’s still a good three-year run of housing, mostly based on just demand. I think you’re going to see housing continue to fuel growing demand in our categories. But I think some of the challenges that we see today, whether it is chips or [whatever], we still have a long way to go with that. It’s probably not going to get better by the end of the year.

JR: If our members keep doing what they’re doing — resilience, adaptability, courage — then we’re going to keep growing with the retail mission to our members. In a strange way, it’s a huge opportunity for them.

JW: Our members are industry experts; they have an easier time navigating chaos than somebody working at a box store who is an hourly employee and doesn’t have that history. So that’s a huge advantage for us.

Q&A

PrimeTime Hit

NMG President and Chief Member Advocate Tom Hickman, on the retail roller coaster of the past 20 months, the return to in-person events, and what’s in store for 2022.

Interview by Tom Samiljan

Founded in 1971, Nationwide Marketing Group (NMG) celebrated its 50th anniversary at its most recent PrimeTime. Held in Nashville in August, it was the first-in person iteration of the event since February 2020. Some 2,000 Nationwide members and manufacturers descended upon the Gaylord Opryland Resort and Convention Center for three-and-a-half days of networking, learning, buying, product-discovery, and more. We sat down with NMG President and Chief Member Advocate Tom Hickman during the show for his perspective on the return to live in-person events, the retail rollercoaster of the past 18 months, Nationwide’s growth during the pandemic, and the coolest trends at the show. Here’s the full interview.

This is the third day of Nationwide’s first in-person PrimeTime since February 2020. How’s it going so far?

Tom Hickman: We’re thrilled with it. We have a really engaged base, so we knew we would get the members because they haven’t seen each other for 18 months, some 580-something days, and there’s just a huge network effect here that happens at these events. It’s not just solving supply-chain problems; it’s not just price and product procurement. And that’s probably my biggest takeaway: that this show is very powerful for the human connection. I think we underestimated the power of the network and the people part of this. We have almost 1,000 retailers out here; they have left their stores at the busiest times of their lives to come and meet with us here during one of the most challenging environments for live events. Overall, there are some 3,000 or so attendees, not just the retailers themselves, but also our vendor partners. We’re thrilled with the number of folks here.

We’re also thrilled with the content. We had a shopper journey panel at the opening keynote with some top CMOs from some of our largest global manufacturers who shared what’s going on in the changing consumer and shopper journey. Then we had a great kickoff speaker who made us all laugh for the first time in a while. There hasn’t been a lot of laughing going on until now, so the engagement has been incredible.

And then, of course, there is still the base part of the business — the buying and the cashbacks — that’s all going on and we’ll get those numbers later, but we feel really good right now.

Tell us more about the networking that happens at an in-person PrimeTime event.

TM: We probably have 40 different networking events at any given time — we have retailer-led panels on what they’ve learned in the pandemic, Women in Nationwide (WIN) networking panels, diversity panels, and the shopper journey panel, to name just a few. There are other meetings and networking events for young leaders, Whirlpool exclusive dealers, an outdoor counsel. There’s networking going on all day, and that’s not even counting the more than 100 Learning Academy sessions, where there’s a lot of back and forth and education going on, but it’s based on networking.

Your last in-person PrimeTime took place right before everything shut down. What were the main topics and concerns then compared to this week’s Summer 2021 show?

TH: Well, I remember vividly we were at our show and we had just started hearing from manufacturers about a coronavirus and how it might cause some hiccups in the supply chain for those that were sourcing product from China, but most people expected it to be an eight-to-10-week hiccup. We closed our offices less than 30 days after those conversations, and probably 60 days later, 1,200 of our retailers were mandated to shut their doors. So it escalated quickly, but right before, at the show itself, we were feeling fantastic.

More specifically, at the February 2020 show in Houston, there was a lot of conversation around the election, because it was an election year. There was also a lot of conversation around growth, because we had very low interest rates and the housing market was on fire. And so, as they say, as housing goes, our business goes, so we had these great expectations and plans, all while keeping an eye on the election, because there’s always a little turmoil around that. We were also talking about a market that was probably going to be up three to seven percent, which in appliances had been the historical average. We were talking about how to continue to grow business, how to grow faster than the market, and how to compete against big box. We were talking about how we could grow 10 percent, which would be great since the industry was growing at three percent.

And then suddenly, we went to how do we keep everyone open, how long will this pandemic last, how do I get funding so my business can stay open? Today we’re up 38 percent, which is almost 30 percent over 2019, and the conversation is now around: I have more customers than I know what to do with, so how do I get product, when’s the supply chain going to get fixed, and how do I maximize the opportunity?

So we’ve seen these three inflection points over the past 18 months. First, it’s going to be good; then, holy crap, something bad happened; and now it’s like, holy cow, we’re trying to hang onto the nose of the cone. It’s been a really interesting kind of roller coaster and I’ve seen more change in 18 months than I’ve seen in 18 years. You kind of have to have your head on a swivel.

How has Nationwide addressed inventory issues for its members?

TH: We have a saying around here: We solve retail problems right. The retail problem now is an always-changing landscape, and digital is going to be a long-term, constantly evolving problem. We have a team of 200 people that work on that. Another tough problem right now is the human asset — finding people in this competitive landscape for pay and benefits. Some of our folks can’t offer insurance to their employees, so we went out and found Lockton, an insurance company that offers an affordable rate. This lets retailers compete for human assets in the market.

Before COVID, we did not have much experience in navigating legislation and lobbying governments on the behalf of retailers. We didn’t have anyone who could read all 1,200 pages of the CARES Act to fully assess the implications for retailers. So we built that skill. We went out and found some folks in D.C. that did just that and brought them on staff. I hope we don’t ever have to lobby state governors to allow our retailers to open their stores and to look at old, antiquated language and laws that say that refrigerators aren’t essential, but now we have that capability. We also rallied our troops and created a COVID response team. That team sourced protective equipment for our members because that was also tough to find, and where were they going to get it otherwise? We’re not perfect by any means, but I think we’re pretty good at identifying a problem, going and finding experience or expertise in that area, and then bringing it into the company to help solve the problem.

How did Nationwide itself address all these changes, and what did it learn and implement that will stick around?